TURN YOUR FINANCES INTO SOMETHING YOU LOVE, ENJOY & CELEBRATE

MAYBE...

You are looking to build an easy-to-follow spending plan, instead of feeling stressed, guilty, and out of control.

You want to understand how to save more, so you feel more secure, rather than feeling like you never have anything to save at the end of the month.

You want to understand investing and feel confident in your decisions, instead of procrastinating and never getting around to it because you think it requires a degree in finance.

If YOU'RE NODDING AFTER ANY OF THESE STATEMENTS, then YOU'RE IN THE RIGHT PLACE! THIS COULD BE the best decision you could make for your financial future!

This course is for people who are serious about transforming their financial future... 🌞

MAYBE

You are looking to build an easy-to-follow spending plan, instead of feeling stressed, guilty, and out of control.

You want to understand how to save more, so you feel more secure, rather than feeling like you never have anything to save at the end of the month.

You want to understand investing and feel confident in your decisions, instead of procrastinating and never getting around to it because you think it requires a degree in finance.

If YOU'RE NODDING AFTER ANY OF THESE STATEMENTS, then YOU'RE IN THE RIGHT PLACE! THIS COULD BE the best decision you could make for your financial future!

This course is for people who are serious about transforming their financial future... 🌞

I agree to hear from Financial Coaching Institute using the contact details I provide.

The systems I provide in the Course help you with 5 different areas of personal finance:

First, we begin with your MONEY MINDSET. Your thoughts and beliefs can cause frustration, stress, and chaos when it comes to your money.

Secondly, we teach you about SMART SAVING and getting Debt-Free, and then how to start building your wealth.

Next, we review your SPENDING PLAN and help you get your expenses organized, to know where your money has been going.

Then we will delve into the world of INVESTING, so you can learn how to calculate the real risks and potential rewards of your investments.

Finally, the course ends with you designing your very own FINANCIAL BLUEPRINT.

Hi there! I'm Ashley.

Since 2007, I have been working with folks to brighten their financial future! As a former financial advisor, brain coach, and now founder of The Financial Coaching Institute, I have been helping clients in virtually every financial aspect you can think of.

From saving and spending, to investing, money mindset, retirement planning, automating, educational planning, personal development, caregiving, estate planning, trading business development, masterminding, family offices, and so much more!

And through it all, I have discovered the subtle nuances that make a BIG difference in the success of the few that thrive vs. the majority that sputter.

That is why I was hired to help others!

I have not only been coaching and teaching it, but I have actually also been using these strategies. I have made lots of mistakes, but I have also done most things thoughtfully, prudently, and successfully. And through it all, here is the most important discovery I can share with you...

As a Christian woman, I strive to live by the principles and values of stewardship, generosity, compassion, service to others, as well as equity and fairness. I wanted the course to have a price tag that makes this affordable and valuable education accessible to any American looking to improve their financial well-being.

While beta testing this course for the price point, the resounding feedback was this is a lot of content for 1 year's access for $199. My advisory board advised me to keep this same price for Phase 2, but for a limited time to celebrate our Country's 250th birthday!

I'm Ashley.

Since 2007, I have been working with folks to brighten their financial future! As a former financial advisor, brain coach, and now founder of The Financial Coaching Institute, I have been helping clients in virtually every aspect of their financial life.

From saving and spending, to investing, money mindset, retirement planning, automating, educational planning, personal development, caregiving, estate planning, trading business development, masterminding, family offices, and so much more!

And through it all, I have discovered the subtle nuances that make a BIG difference in the success of the few that thrive vs. the majority that sputter.

That is why I was hired to help others!

I have not only been coaching and teaching it, but I have actually also been using these strategies. I have made lots of mistakes, but I have also done most things thoughtfully, prudently, and successfully. And through it all, here is the most important discovery I can share with you…

As a Christian woman, I strive to live by the principles and values of stewardship, generosity, compassion, service to others, as well as equity and fairness. I wanted the course to have a price tag that makes this affordable and valuable education accessible to any American looking to improve their financial well-being.

While beta testing this course for the price point, the resounding feedback was this is a lot of content for 1 year's access for $199.

My advisory board advised me to keep this same price for Phase 2, but for a limited time to celebrate our Country's 250th birthday! During this time I will also be donating $17 from each sale to charity.

Why Now?

The current state of “financial warfare” combined with the rise of inflation has

most Americans struggling.

You Can Finally Get the Financial Education You Deserve & Need!

This “financial warfare” combined with the rise of inflation has people like you struggling.

I have had many conversations at my local grocery store – and overheard conversations – where people are having to be more thoughtful about their grocery purchases. They put items back. What?! America is one of the richest countries in the world.

And yet some people are thriving with this new world economy!

You Can Finally Get the Financial Education You Deserve and Need!

What is the Rewire for a Wealthy Brain Course?

Rewire for a Wealthy Brain Course is a five-module training program that gives you the clarity and confidence to really take control of your finances.

Since 2007, I have been working with coaching clients and I have narrowed personal finance down into a few key strategies that can make a BIG difference for you and your family. And each module is delivered right away upon purchase, to help you get the maximum results of “choosing your own adventure.”

We have intentionally designed this self-led learning experience for you!

What do I get with each module?

MODULE 1

Your Money Mindset Strategy

Money Mindset is about accessing the approach or framework you have adopted to manage your attitudes, beliefs, and behaviors towards money, thereby influencing your financial decisions and overall wealth trajectory.

In Module 1, You Will Learn:

The three reasons YOU need to create your financial blueprint. The REAL reasons may be vastly different than what you would expect. And when you know this, you can strategize better, make decisions that are most impactful to you, and help position yourself for building your wealth. Understanding these reasons will give you a HUGE strategic advantage.

The twenty must-have pieces of scientific research about exercises you need to know to open your mind to learn, think strategically, and to be receptive to changing the habits that do not serve you. I will show you exactly how to use this information. Knowing this, as you move to the saving, spending, and investing pillars, you will be MUCH more likely to adopt best practices early on — which is what you want because that is what can give you the biggest transformation when it comes to your finances.

The twelve must-have strategies to being focused and why you must be intentional and hyper-focused on growing your wealth more now than EVER before. Focus allows for your creative side to flourish and helps provide solutions to your own financial issues.

The “less stress” philosophy. Everything in the Money Mindset Strategy is intentionally designed around two core beliefs that I have about money — maximize money management, while minimizing stress. There are a lot of things you can do with your money. But one of the most important discoveries I had was if your finances become overwhelming for YOU or your family, it’s going to be a struggle. My goal is to show you how to make personal finances less stressful, exciting, and fun.

Once you have nailed the mindset foundation, then it's all about growing your savings!

MODULE 2

Your Smart Saving Strategy

Smart Saving is your strategy for building and growing your savings. I will hand over my debt-free system and secrets for saving for your specific needs and desires, PLUS share with you the keys to creating the ultimate Sinking Fund that has been proven to work time and time again.

In Module 2, You Will Discover:

We start by figuring out your Saving personality. You will discover your Saving Spirit Animal, along with the strengths and weaknesses that come with it. Then you will find out the best characteristics of the Spirit Animal you are least like to help you be a better saver!

The tactical step-by-step system for being debt-free in 5-7 years… that is FAST — even if you don’t know where to start or you are overwhelmed!

How to create savings with several types of Saving Challenges. This is NOT about you being stuck on a treadmill using your savings every month to cover expenses. This is about you designing a savings strategy that may provide a better feeling of security against unexpected events.

The secret to creating a Sinking Fund for your Savings — and the key components to earning a higher rate of return. Your strategy incorporates earmarking dollars to provide more security against unexpected expenses.

As someone who makes decisions every day about your spending, it is super important that you continue to make decisions that help you grow and build your wealth. Your spending plan is the lifeblood of your financial life because this is how you make your dreams a reality!

Next, we will dive into your Spending Plan Strategy!

MODULE 3

Your Strategic Spending Strategy

This is a deliberate and purposeful approach to allocating financial resources in a manner that aligns with your values, priorities, and long-term goals. It involves careful planning, actively adjusting, and decision-making to optimize spending and maximize the value derived from each dollar spent. This strategy includes prioritizing expenses, minimizing discretionary spending, and directing resources towards investments or experiences that contribute to personal fulfillment, financial stability, and long-term wealth.

In Module 3, You Will Learn:

How to find out what your Spending Personality is. You will discover your Spending Spirit Animal, which could be different from your Saving Spirit Animal. You will once again pick up some strategies to help you be a more strategic spender!

The Spending Plan Path… which, regardless of your past experiences, can provide you tremendous clarity and momentum (and that may be one of the reasons you want to change your money habits). I will walk you through getting organized and creating your own path and why it may be the secret to your never-ending success.

The #1 reason WHY people fail with budgets… and how to structure your Spending Strategy to avoid it. Did you know that most people fail when trying to create a “budget”? The word sounds as restrictive as the word “diet.” The reality is that most Americans create an income and make decisions daily that can have lasting impacts. We want to change the negative spending habits, and adopt healthy and wealthy ones instead. It could make all the difference.

Understand the financial warfare you are in for each and every one of your dollars. If you are thinking that you are not being manipulated out of your money – think again! There is a psychology of sales and marketing, and their strategy is to get you to part with as much of your money as possible. They know you and have figured out your Lifetime Value to them. The game is afoot!

The more strategic you are with your spending, the more peace and freedom you will create for yourself!

Once we've designed your spending plan, then we shift gears to focus on your investing strategy.

MODULE 4

The Savvy Investing Strategy

The Savvy Investing Strategy entails a systematic and informed approach to investing aimed at optimizing returns, while managing risk.

When it comes to investing, there are a million things you can do. I cut through the clutter and share with you the proven strategies that we use over and over again at the Financial Coaching Institute. It involves research, prudent decision-making, and a long-term perspective.

Note: Investing involves risk. There is always the potential of losing money when you invest in securities.

In Module 4, You Will Discover The Key Elements Of Investing:

Determining your Investing Personality. You will discover your Investing Spirit Animal, which might be REALLY different from your Saving and Spending Spirit Animals. You will once again learn new strategies to help you be a savvier investor!

Getting Organized… which, regardless of your investment experience, I find that many clients have haphazard retirement assets lying around, such as 401K’s, IRA’s, Roth’s, inherited accounts, etc. We kick off this module by getting organized and learning what you have. Using 5th grade math, I will share with you how to calculate your rate of return, so you can better understand its REAL performance.

The Top Investing Mistakes… and how to structure your Investing Strategy to avoid them. Whether you manage your money yourself, or have someone else do it for you, there are some principles and rules you need for each and every investment you own. For example, every investment dollar needs an Emergency Exit. I can’t stress enough the importance of having a contingency plan or exit strategy in place for each investment to mitigate potential losses and manage your risk effectively.

Understand the different investment choices. Do your eyes cross at the thought of understanding your investment choices? Does financial lingo and jargon confuse you? Do you feel like you need a degree in Finance to figure all this out? I break down the terms and definitions in a simple, easy-to-understand format. Don’t be confused about basic investment terminology again!

But it doesn’t stop there, because then it’s about putting it all together to create your own money blueprint.

MODULE 5

Your Money Blueprint Strategy

In the Money Blueprint Strategy, we get into the “how-to” specifics of executing HIGHLY effective blueprints and roadmaps for your money.

It encompasses you creating a financial plan tailored to your goals, income, expenses, and assets, to help provide a simple structured framework for managing your finances, achieving financial milestones, and building your long-term wealth.

In This 5th And Final Module, You Will Learn:

How to properly structure and phase your blueprint, so that you can get maximum impact! PLUS, our step-by-step process and exact money blueprint template.

The seven signs to watch out for - that you are getting off course - and slowing down your traction to building wealth AND some strategies to keep your momentum from fizzling out.

Understand WHY the first 66 days are critical to your success… and the key actions you want to take to ensure your peace and happiness.

Simple Tools and Exercises to keep you engaged… and the easy and quick steps you want to take to leverage your finances.

Your Blueprint should align with your values, priorities, and aspirations. By creating and adhering to your Money Blueprint, you can optimize your financial decisions, minimize financial stress, and can work toward a more secure and prosperous future.

Just be warned, many of the strategies in these modules will be counterintuitive to what most people normally teach. But you don’t want “normal” results.

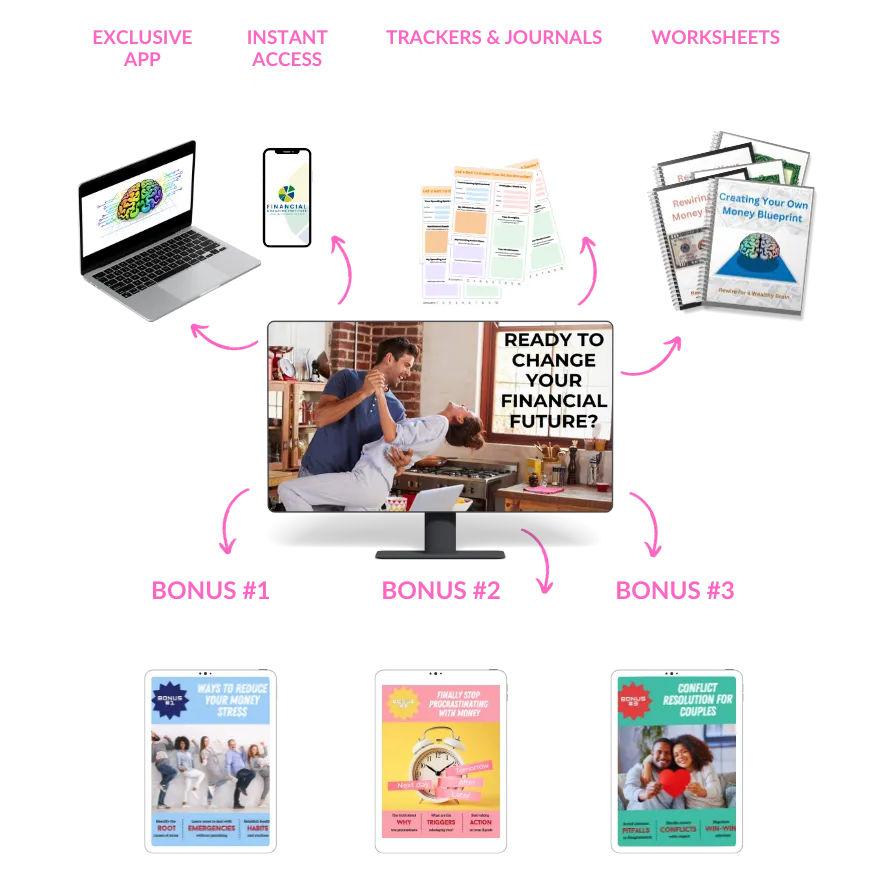

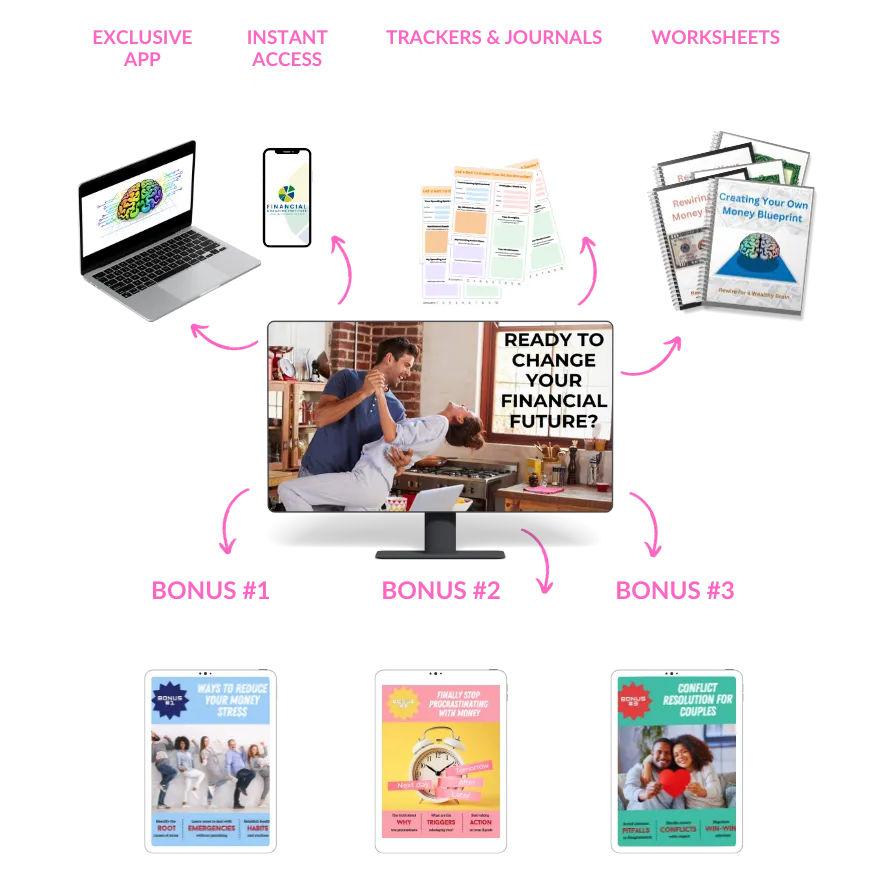

IF ALL THIS WASN’T ENOUGH, I HAVE DECIDED TO SWEETEN THE POT EVEN MORE...

We want you to have everything you need to succeed, and you know that we love to take care of you. That is why I am also including some bonus foundational and advanced trainings.

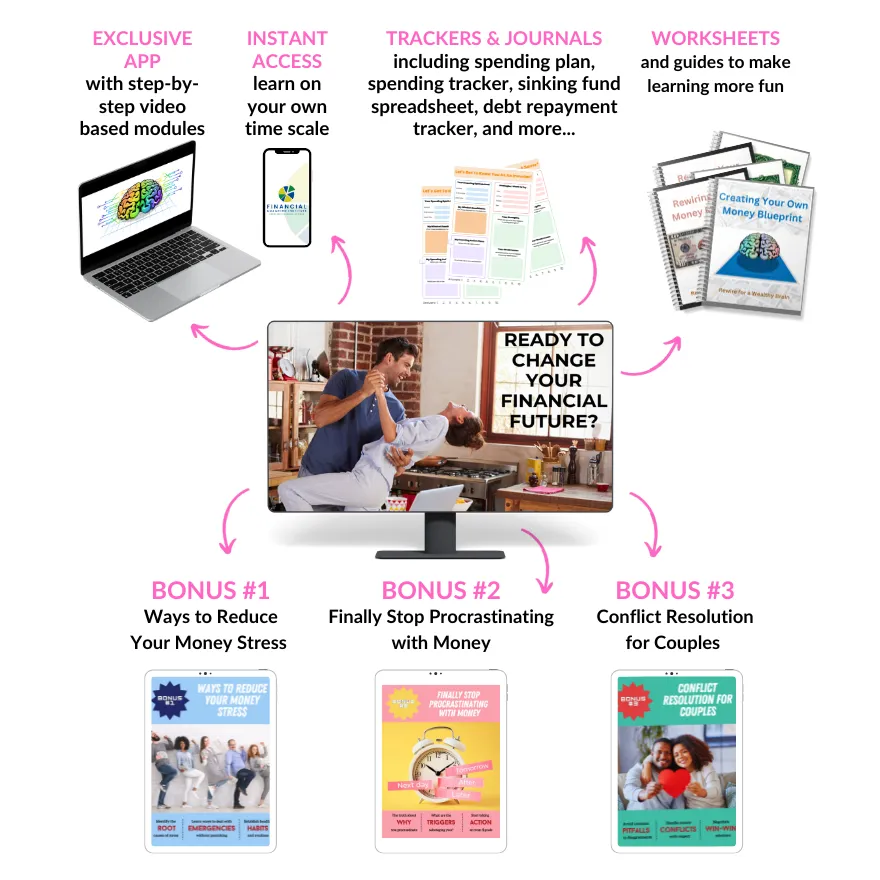

BONUS #1 - WAYS TO REDUCE YOUR MONEY STRESS

In this bonus, I will show you exactly how you can reduce your money stress, to help you gain peace and clarity with your personal finances. I will also walk you through my proven scientific strategies and provide you step-by-step directions for various methods I found to be the fastest and easiest ways to reduce financial planning pain points and stress. And if you already have some stress relieving techniques, you are going to be able to learn a few new strategies to biggie size your peace!

VALUE $197

BONUS #2 - FINALLY STOP PROCRASTINATING WITH MONEY

This is not your “average” online course bonus. This “can’t miss” experience can deepen your understanding about why you procrastinate and help you get things done even faster. Not only will you learn from me about my journey and my client’s journeys, but you will also discover the most cutting-edge scientific research and working solutions that are getting crazy results, and you can decide firsthand what you want to try!!!

VALUE $297

BONUS #3 - CONFLICT RESOLUTION FOR COUPLES

Ever had an argument, fight, or disagreement with a loved one about money? Ever had the same one over and over? My husband and I call this the “hoe-down.” We keep circling around the same issue, and get stuck in this emotional cycle, thereby upsetting, triggering, and frustrating each other, and never getting a real solution. We created this resource that really works for us and the many other couples we have shared this with. It is a quick and easy step-by-step process that is super simple to use and can keep you out of that “hoe-down.”

VALUE $197

HOW DOES the REWIRE FOR A WEALTHY BRAIN Course WORK?

All the course materials, downloads, and instructions are provided on our members-only website or app.

You will be able to follow along and learn at your own pace. Each module is comprised of several short video lessons.

Downloadable tools and resources are also provided so that — no matter how you like to take action — we have you covered.

We also have fun, interactive components that help you retain more of what you have learned. AND the entire site and app is optimized for your mobile device so that learning on the go is easy and convenient!

You would expect to find this course for $2,000, $3,000... even $5,000 but for a limited beta testing time, I am making it available to you for 1-year access at the special price of only $199, so act fast and secure your spot now.

We can't wait to see you take your first step towards financial clarity, confidence, and control and to help you create a wealthy brain and life!

Click below to join us on this transformational journey.

DON'T MISS OUT ON THIS HUGE SAVINGs!

While beta testing this course for the price point, the resounding feedback was this is a lot of content for 1 year's access for $199 –

“it sounds too good to be true”... so allow me to explain:

As I previously stated, I strive to live by the principles and values of stewardship, generosity, compassion, service to others, as well as equity and fairness.

The second phase allows this course to have a price tag that makes this affordable and valuable education accessible to any American looking to improve their financial well-being.

To honor our Country's 250th birthday, I am donating at least $17 from each course sale to charity!

After completing my course, not only do I hope you feel empowered to improve your own life, but you are also able to give back and continue this legacy in your own way.

WHO IS THE REWIRE COURSE FOR?

Our clients range from young adults who may have never been taught about personal finance, famous people, retired folks, to multi-million-dollar family offices. So, if you are an aspiring financial wizard or an experienced person with wealth, or anyone who wants to work to improve your financial situation, and you’d like a proven plan to guide you along the way, then the Rewire for a Wealthy Brain Course is for you.

WHO IS THE REWIRE COURSE NOT FOR?

Our course is for people who are committed to learning and taking action to improve their financial future. If the commitment isn’t there, then this is NOT the right program for you, and I ask that you please do not sign up.

If you are someone who likes to focus on why something “wouldn’t work,” then this is not for you either. As I stated before, many of the strategies are counterintuitive to what most people teach — and that’s partly why they work so well. You have to be open to what I am sharing otherwise it’s going to be a frustrating experience for both of us.

Our course is for people who are committed to learning and taking action to improve their financial future. If the commitment isn’t there, then this is NOT the right program for you, and I ask that you please do not sign up.

THIS SOUNDS TOO GOOD TO BE TRUE FOR $199!

While beta testing this course for the price point, the resounding feedback was this is a lot of content for 1-year access for $199 – “it sounds too good to be true.”... so allow me to explain:

As a Christian woman, I strive to live by the principles and values of stewardship, generosity, compassion, service to others, as well as equity and fairness. My financial knowledge has cost me a lot of time and money – over decades – to acquire this information and create some of my own tools and resources. My goal was to design a course with a price tag that makes this affordable and valuable education accessible to any American looking to improve their financial well-being.

After completing my course, not only do I hope you feel empowered to improve your own life, but you are also able to give back and continue this legacy in your own way.

I DON'T HAVE TIME FOR 'SOMETHING ELSE'!

The last thing you and I want is something else on our to-do list. That’s where our course is unique. With years of experience coaching and consulting clients, I know what works for student success. That’s why the entire course has been intentionally structured to help you absorb the content and get your blueprint executed fast. Once you start to take steps with your plan, it will create time and space for the things that matter… without having to constantly “scramble” to keep up.

HOW IS THIS DIFFERENT FROM OTHER COURSES?

This is the only course that is based on years of best practices from financial advising, coaching, consulting, planning, brain coaching, and professional investing. None of this is based off a one-time success. It’s the accumulation of strategies, from hundreds of different clients, all distilled down into a blueprint for recurring success. You don’t have to experiment all the time to hopefully find something that works. Just follow your blueprint. Most of these strategies have been scientifically proven to work over and over again. And don’t forget, I have been doing this myself having experienced managing both high 6-figure and 7-figure income clients. And in every module, I personally train you!

I DON'T WANT TO CREATE ANOTHER JOB FOR MYSELF.

Me neither!

That’s where each strategy that is outlined in the Rewire for a Wealthy Brain Course is designed to help you take high-value action in a super-efficient way.

I ALWAYS GET STUCK IN THE TECHNOLOGY.

The good news is the technology options available today make this a LOT easier. In fact, inside the Rewire for a Wealthy Brain Course, we have resources dedicated to walking you through the options you have to set up and execute your money blueprint. At the end of each training module, you will know exactly what electronic or paper solution might be best for you. So, no matter what option is right for you, you will be fully aware of your choices.

"BUT THERE IS ALREADY SO MUCH FREE CONTENT AVAILABLE TO ME!"

You are right. That is why you need to enroll in the course!

Here’s why…When there is a lot of free content, it creates confusion and overwhelm. People don’t know what to do or who to follow. Today more than ever, people don’t want “more stuff.” They want clarity and direction.

I will walk you through what I have found to be the most effective ways to improve your financial future. And when you start using these strategies, you will stand out like a beacon of light. Because when everyone else is overwhelmed, you will be living with clarity, confidence, and financial momentum.

Besides, if all that “free advice” were really working, wouldn’t every American be a multi-millionaire?

WHAT'S INCLUDED WITH REWIRE FOR A WEALTHY BRAIN?

You get 5 modules of training sessions: Rewiring Your Money Mindset, Smart Saving, Strategic Spending, Savvy Investing, and Creating Your Own Money Blueprint. You will receive digital worksheets and all necessary files when you access each session.

As Bonus #1, you also get "Ways to Reduce Your Money Stress." This is valuable training that will teach you proven strategies to help you cope with financial stress, calm your mind and body, and help boost your confidence and resilience.

As Bonus #2, you also get "Finally Stop Procrastinating with Money." By the end of this training, you will have the tools to feel more confident and to finally stop procrastinating with money and start living the financial life you deserve.

As Bonus #3, you also get "Conflict Resolution for Couples." In this training, you will learn how to communicate effectively with your partner about financial matters, avoid common pitfalls and disagreements, and create a shared vision for your future. Whether you are married, engaged, or dating, this training can help you strengthen your relationship and build trust and harmony around money.

WHAT WILL I LEARN?

In Rewire for a Wealthy Brain, you'll learn and receive:Step-by-step directions to determine your money personality. Tips and tricks to improve your money skills that are customized to your spirit animal. Tools to identify and eliminate mental blocks to financial success.Learn how to live frugally without compromising your lifestyle. Expert budgeting techniques to save more and achieve your goals.Create an emergency fund and plan for unexpected expenses.Spend mindfully and align your purchases with your values and priorities.Maximize the value of your spending and get the best deals possible.Understand different investment options and how they work.Analyze and evaluate investment opportunities and risks.Create a comprehensive blueprint that reflects your unique goals, values, and aspirations.Set achievable financial goals and create actionable steps to reach them.Develop a roadmap for long-term financial success and monitor your progress along the way.

ARE THE WORKSHEETS A REAL BOOK?

The course worksheets are not a physical book; it is a comprehensive system provided in multiple digital documents. Please keep in mind that all materials are delivered digitally in PDF, Word, and Excel formats.

CAN I GET A PHYSICAL COPY? At this time, our course materials are only available in digital formats. You can print the entire bundle, and have it bound or keep it in a 3-ring binder, or you can print just the pages you need.

HOW SOON AFTER PURCHASING WILL I RECEIVE MY COURSE?

The course materials will be available digitally after the setup of your account via the email address you provide at checkout. At the beginning of each course, you will see the digital files available to download and print to enhance your training. Each tool or resource has step-by-step instructions for quick implementation!

HOW DO I KNOW WHETHER THIS COURSE IS RIGHT FOR ME?

Our educational program is for anyone who is ready to get their finances in order and may be intimidated, overwhelmed, or confused by saving, spending, or investing. The course is designed to increase confidence and help you take control of your money. If you are already managing your own money and are happy with your results, then this course is not for you. We coach people who are trying to figure it all out without it becoming a second job.

HOW MUCH DO I NEED TO INVEST?

We are often asked about the minimum investment. We are not a broker/dealer, so that amount is dependent on the minimum account value required by your brokerage firm. We have seen clients begin with as little as $500 to get started with their Roth IRA.

Here's an example: if you have $1,000, you can buy 100 shares of a $10 stock. We do not require a net worth or account minimum to educate you about investing.

Note: Investing involves risk. There is always the potential of losing money when you invest in securities. Consult your brokerage firm for additional details.

HOW MUCH TIME DOES THIS TAKE?

We suggest you go through all 5 modules. However, we like to think of this as a "choose your own adventure" training. We suggest everyone goes through the first and final modules, but feel free to jump to your favorite or most desired topic between Smart Saving, Strategic Spending, or Savvy Investing. The total time depends on your action plan and the blueprint you design. The average time to get through all the training modules, including the bonuses, is about 7 hours.

WHAT'S THE PRICE?

The Rewire for a Wealthy Brain Course is offered at $199... and to celebrate our country's 250th birthday I will be donating $17 from each sale to charity.

WHAT IS THE VALUE?

Seven hours of personal finance training at Financial Coaching Institute is $3,998.

Plus, you receive Bonus #1: Ways to Reduce Your Money Stress (another $197 value).

You also receive Bonus #2: Finally Stop Procrastinating with Money (a $297 value).

Finally, you get Bonus #3: Conflict Resolution for Couples (a $197 value).

You are given numerous tools throughout the course (a $497 value).

You receive over $5,173 value in course for only $199.

WHAT IS YOUR RETURN POLICY?

Since we sell digital educational and informational products, we do not allow return/refunds. We have taught thousands of clients these tips and tricks, and feel confident that you will learn invaluable information.

Here's ANOTHER QUICK OVERVIEW everything you get with Rewire FOR A WEALTHY BRAIN

Five Comprehensive Modules: Dive into video lessons, worksheets, quizzes, and exercises that address everything from money mindset, saving, spending, and savvy investing.

Discover Your Money Personality: Uncover how your unique traits affect your financial decisions and how to use them to your advantage.

Overcome Limiting Beliefs: Break free from the mental barriers that have kept you from achieving your financial potential.

Actionable Strategies: Get practical, step-by-step guidance on how to implement smart financial habits into your daily life.

Expert Tips and Resources: Access a wealth of knowledge to optimize your financial performance.

+ Exclusive Bonuses to Supercharge Your Financial Transformation

Bonus #1: Ways to Reduce Your Money Stress (Valued at $197 - Yours FREE)

Gain proven strategies to manage financial stress, and develop a positive money mindset, enhancing your financial peace and well-being.

Bonus #2: Finally Stop Procrastinating with Money (Valued at $297 - Yours FREE)

Learn why you procrastinate with money and how to conquer it. This bonus equips you with the tools to take immediate action towards your financial goals, boosting confidence and breaking the cycle of procrastination.

Bonus #3: Conflict Resolution for Couples (Valued at $197 - Yours FREE)

Navigate financial discussions with your partner with ease. This training provides strategies for effective communication, avoiding disagreements, and building a unified financial future.